Coke vs. Gold Update

8/13/21

In my article from 8/16/16 Coke vs. Gold, I decided to compare Coke stock (KO) to 1g of gold since they were close in value, $43.91 (paying a dividend of $1.40/share/year) and $43.04 respectively. I reasoned or speculated that the stock KO will beat 1g of gold moving forward in terms of overall investment, and said I'd check in on them every year.

The time has come again to do the checking for 2021.

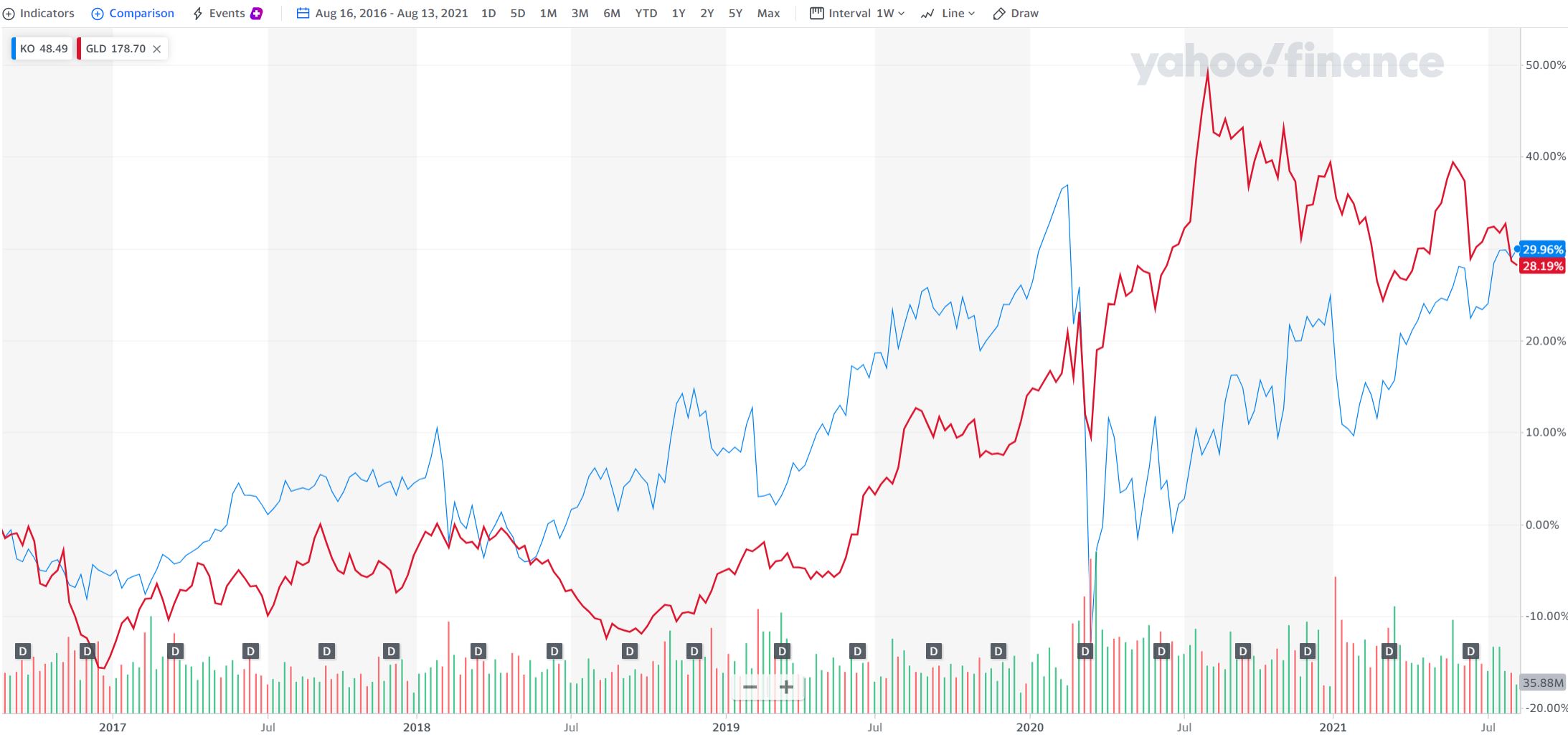

Here is a graph of the performance of KO and GLD since 8/16/16

As we can see from the graph, KO is +29.96% and gold is +28.19% over this time period. Additionaly, KO's dividend has increased 20% from 2016 to 2021.

To summarize, if we started 8/16/16 with 1 share of KO, and 1g of gold, we'd have:

- 2016, KO = $43.91, $1.40/yr, 1g gold = $43.04

- 2017, KO = $46.20, $1.48/yr, 1g gold = $41.45

- 2018, KO = $46.08, $1.56/yr, 1g gold = $37.78

- 2019, KO = $53.74, $1.60/yr, 1g gold = $49.17

- 2020, KO = $50.19, $1.64/yr, 1g gold = $64.29

- 2021, KO = $57.07, $1.68/yr, 1g gold = $57.26

It looks like there was a recovery in the price of stocks, probably due to recovering from the effects of COVID on the economy. Gold, on the other hand, seems to have had somewhat of the opposite effect. Let's check back in on how they are doing around 8/16/22 (and every year anniversary after).

Thanks for reading.

Please anonymously VOTE on the content you have just read:

Like:Dislike: