Receiving Investment Income Everyday, Part 3

7/21/16

In my original Receiving Investment Income Everyday article, I tallied the days of the year that I received dividend or interest payments from stocks, Treasuries, and peer to peer notes for the year 2013. I did this because while some concentrate on total yearly or monthly income, I wanted to concentrate on daily income.

I just completed tallying the numbers for 2015, and I present them in this article.

In 2015 I received 1,061 dividend payments from monthly, quarterly, biannual, and yearly dividend payers that I own. I purchased many dividend paying companies over the year, and the dividend paying companies I already had, in general, continued paying dividends.

Currently, about 28.68% of my stocks are monthly dividend payers, 55.88% quarterly dividend payers, 2.94% biannual dividend payers, 2.94% yearly dividend payers, and the remaining 9.56% do not pay any dividends.

Of course, these received dividend payments did not all fall on different days; there was a lot of overlap. I omit the table here, but there are 202 days total where I received at least one dividend.

However, this is just dividend income from stocks. What about my other payments, such as interest from P2P notes and interest payments from Treasuries? How much more would these payments "fill in" things?

In 2015, I started out with just a few P2P notes, having liquidated much of my P2P notes in 2014. However, I slowly started re-accumulating P2P notes in 2015. Adding in payments from these P2P notes, as well as from Treasuries (I have Bills, FRNs, Notes, Bonds, and TIPS of all types of maturities), we get 229 days.

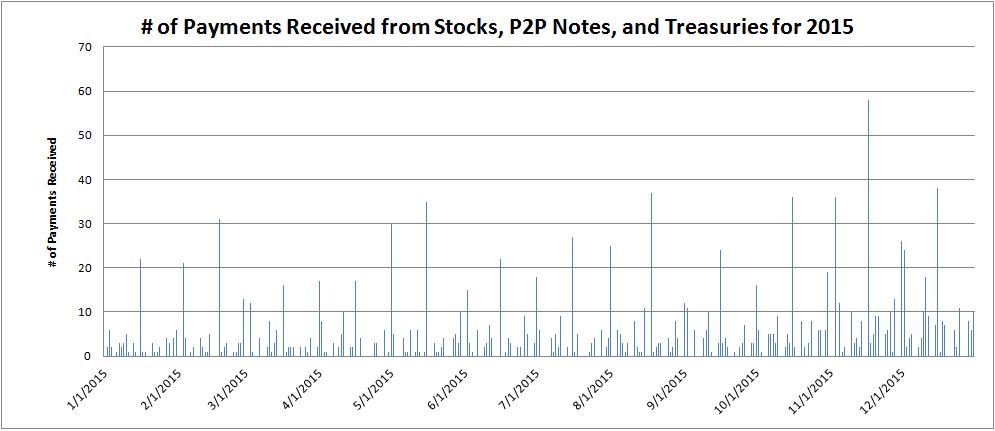

Graphically, the counts of the payments received from stocks, P2P notes, and Treasuries for 2015 looks like:

For 2013, my % of the days in a year which I was receiving income from investments was 184/365 or ~50%. For 2014, this ratio was actually 289/365 ~ 79.18%. For 2015, this ratio is 229/365 ~ 62.74%. My goal was for this ratio to be around 85% for 2015, so that didn't happen. I believe some reasons were: the number of P2P notes I had was small for this year, the Federal Funds rate only increased a very tiny amount, and therefore I'd often receive $100 after spending $100 on a Treasury Bill, and there was a lot more overlap in the days dividends were paid.

For 2016, I hope to buy a few more dividend paying stocks, as well as gradually increase the number of P2P notes and Treasuries. I also hope to see the Federal Funds rate increase some more.

Please anonymously VOTE on the content you have just read:

Like:Dislike: